In today's fast-paced business world, having a reliable banking partner is essential. NorthOne Business Banking has gained attention for its tailored services aimed at small businesses and freelancers.

This review delves into the features, benefits, pricing, pros, cons, and overall value of NorthOne Business Banking in 2024.

What is NorthOne Business Banking?

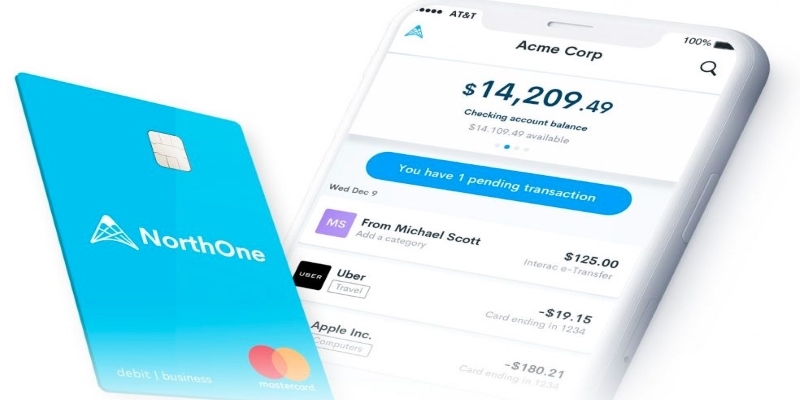

NorthOne Business Banking is a financial technology company that provides banking services specifically designed for small businesses, startups, and freelancers. It offers a range of banking products through its user-friendly mobile app, focusing on simplicity and efficiency. NorthOne aims to streamline financial management for its users by offering tools that integrate with other financial software and services.

NorthOne Business Banking: Features, Benefits, Pricing, and Much More

NorthOne Business Banking has positioned itself as a leading option for small businesses, startups, and freelancers looking for streamlined financial services. Heres a detailed look at what NorthOne offers:

Easy Account Management

NorthOne makes opening and managing a business bank account straightforward and hassle-free. The entire process can be completed online within minutes. The mobile app is designed with a user-friendly interface that allows you to handle all banking activities on the go. You can view your balance, track expenses, and categorize transactions easily, which helps maintain clear financial records.

Integrations with Popular Tools

One of the key benefits of NorthOne is its ability to integrate with various accounting and financial management tools. This includes well-known platforms like QuickBooks, Xero, PayPal, Stripe, and Shopify. These integrations mean that your transactions are automatically synced, reducing manual entry and the risk of errors. This seamless connection helps streamline your financial operations, making bookkeeping and financial reporting more efficient.

Envelopes for Budgeting

NorthOne offers a unique budgeting tool called Envelopes. This feature allows you to allocate funds to different categories, such as payroll, taxes, rent, and other expenses. By setting aside money in these virtual envelopes, you can ensure that funds are available for essential payments, helping you manage your budget more effectively and avoid overspending.

Real-Time Notifications

Staying on top of your financial activities is crucial for any business. NorthOne provides real-time notifications for all transactions, including deposits, withdrawals, and other account activities. This feature helps you monitor your account closely and detect any unauthorized transactions immediately, enhancing your security and financial control.

Customer Support

Customer support is a significant aspect of NorthOnes service. They offer assistance through various channels, including live chat, email, and phone support. The support team is known for its responsiveness and expertise, ensuring that you can get help whenever you need it. This level of support is particularly valuable for small business owners who may not have the time to troubleshoot issues on their own.

ATM Access and Deposits

NorthOne provides access to a large network of ATMs, making it convenient to withdraw cash without incurring additional fees. Additionally, through its partnership with Green Dot, you can deposit cash at various retail locations. This feature expands the accessibility of banking services, even though NorthOne does not have physical branches.

Secure Banking

NorthOne prioritizes security. It employs advanced security measures, including encryption and two-factor authentication, to protect your account and personal information. These protocols ensure that your financial data remains safe from unauthorized access and cyber threats.

Pricing

NorthOne operates on a straightforward pricing model. They charge a flat monthly fee of $10, which includes all their banking services. This fee structure is transparent, with no hidden charges for transactions, ATM usage, or customer support. This predictability in costs can be a significant advantage for small businesses managing tight budgets.

NorthOne Business Banking: Pros and Cons

NorthOne Business Banking has quickly become a popular choice among small businesses and freelancers due to its tailored services and user-friendly approach. However, like any financial service, it has its advantages and disadvantages. Heres a detailed look at the pros and cons of using NorthOne Business Banking.

Pros of NorthOne Business Banking

User-Friendly Interface: NorthOne's mobile app is designed to be intuitive and easy to use. The account setup process is quick, and managing your finances on the go is straightforward. This ease of use is particularly beneficial for small business owners who may not have a background in finance.

Integration Capabilities: NorthOne integrates seamlessly with various accounting and payment platforms, such as QuickBooks, Xero, PayPal, Stripe, and Shopify. These integrations automate the synchronization of transactions, reducing manual data entry and errors, which can save time and improve financial accuracy.

Transparent Pricing: NorthOnes pricing is simple and transparent. For a flat monthly fee of $10, users get access to all banking services without any hidden charges. This predictable cost structure helps businesses manage their finances more effectively, avoiding unexpected fees.

Cons of NorthOne Business Banking:

Limited Physical Presence: NorthOne operates as a digital-first bank, which means it does not have physical branches. This can be a disadvantage for businesses that prefer in-person banking services or need to conduct frequent cash transactions.

Cash Deposit Limitations: While NorthOne does offer cash deposit options through its partnership with Green Dot, these options are more limited than those of traditional banks. This can be a drawback for businesses that handle a significant amount of cash.

No Interest on Deposits: NorthOne does not offer interest on account balances. For businesses looking to earn interest on their deposits, this could be seen as a disadvantage compared to other banking options that provide interest-bearing accounts.

NorthOne Business Banking: Is it Worth it?

Deciding whether NorthOne Business Banking is worth it depends on your business needs. If you value ease of use, integration with financial tools, and straightforward pricing, NorthOne is an excellent choice. Its budgeting tools and real-time notifications are particularly beneficial for small businesses that need to keep a close eye on their finances. However, if your business relies heavily on cash transactions or requires frequent in-person banking services, you might find NorthOne's limitations challenging.

Conclusion

NorthOne Business Banking presents a compelling option for small businesses and freelancers looking for a modern, efficient, and cost-effective banking solution. With its user-friendly mobile app, integration capabilities, and transparent pricing, it simplifies financial management.

While it may not be ideal for every business, especially those requiring extensive cash handling or physical branch access, its features and benefits make it a strong contender in the business banking space. As always, consider your specific needs and circumstances when choosing a banking partner to ensure the best fit for your business.

In-Depth Review of TradingDiary Pro 2024: Is It Worth the Investment

Do I Qualify For Free Tax Filing? How To Avoid The Upgrade Trap

Unpacking the Halo Effect: A Comprehensive Overview

Understanding Payday Loans and Personal Loans

How Do Credit Scores Become Determined?

Wagmo Pet Insurance Uncovered: Features, Pros, and Cons Explored

Progressive Business Insurance

A Quick Guide to GAAP for Small Businesses

2024 Showdown: OneUp Trader vs TopStepTrader for Funded Trading Accounts

Maximizing Your Travel: Is Orbitz Rewards Credit Card Your Ticket to Savings?

Quontic Bank vs. Ally Bank 2024: Comprehensive Comparison